the various sorts of home loans

Some home loan terms are as short as five years while others can run 40 years or longer. Extending settlements over even more years may lower the regular monthly repayment, however it additionally enhances the overall quantity of interest the borrower pays over the life of the financing. Interest-only home loans– With an interest-only home loan, the customer pays just the interest on the finance for a set time period. Afterwards time is over, typically between five and 7 years, your regular monthly settlement raises as you begin paying your principal. With this type of funding, you will not construct equity as quickly, because you're at first only paying passion.

The quantity you pay each month might change due to modifications in property tax as well as insurance policy prices, however, for one of the most component, fixed-rate home loans use you a really foreseeable regular monthly settlement. Those with a consistent income, who do not have various other substantial financial obligations are the best prospects for a 10-year, set rate car loan. Since the car loan amount is shorter, the monthly payment is typically greater, however to compensate, these car loans are provided at competitive mortgage rates of interest.

- The interest rate billed is the Bank of England's Base Rate plus an agreed margin.

- USDA finances do not need down payments, yet you will certainly still need to cover closing expenses.

- No Social Protection Number Required.Every home-buyer does not have a social safety and security number.

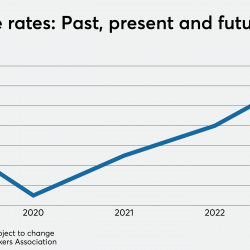

- Variable rate mortgages supply a fluctuating rate of interest over the duration of your home mortgage, which can transform the amount of your regular monthly settlements.

A tracker home loan relocates directly according to the Financial institution of England's official rate. Examining your credit report as much as 6 months previously applying for a home mortgage can give you time to have actually any kind of errors dealt with and also address any areas for concern. A benefit of a SVR home mortgage is that the debtor is typically complimentary to overpay or leave the contract without incurring a penalty. For example, if an individual gets a $250,000 home mortgage to acquire a house, after that the principal car loan amount is $250,000. " How can I tell if I am working with a home mortgage broker or a home loan loan provider? " What's the difference in between a home loan broker and also a mortgage lender?

What Is The Payment Tenor Of A Loan Against Property?

The two most typical sorts of home mortgages are fixed-rate and also adjustable-rate mortgages. Wholesale loan providers don't function directly with customers, but stem, fund, and also sometimes service finances. As an example, a property property buyer promises their home to their loan provider, which then has an insurance claim on the home. This ensures the lending institution's passion in the residential property must the buyer default on their financial commitment. In the case of a repossession, the lending institution might kick out the homeowners, market the home, and also utilize the money from the sale to settle the home loan financial obligation.

Standard Variable Rate Svr Home Mortgages

We're below to supply our clients exceptional cost cost-free home mortgage guidance. Our professional consultants will aid you protect the very best home loan bargain whether you're a very first time buyer, remortgaging your home, purchasing to allow or moving up the residential or commercial property ladder. We'll assist you throughout the home mortgage process– no concealed prices or shocks, just uncomplicated, sincere, home loan advice.

What Are The Major Kinds Of Mortgage Lending Institutions?

The 7/1 ARM has a preliminary interest rate that is taken care of for the very first seven years of the finance. After the 7 years is up, the price then readjusts each year for the remainder of the car loan. The loan has http://reidszgw531.raidersfanteamshop.com/exactly-how-the-fed-s-price-decisions-influence-home-loan-prices a life of three decades, so the homeowner will certainly experience the first security of a More help 30 year mortgage at an expense that is lower than a set price home loan of the same term. However, the ARM may not be the best option for those time share definition planning on having the same residence for over 7 years unless they frequently make additional payments & intend on paying off their financing early. The 10/1 ARM has an initial rates of interest that is fixed for the first ten years of the car loan. After the one decade is up, the rate then adjusts yearly for the remainder of the loan.

Ingen kommentarer endnu