exactly how does a reverse home mortgage work in canada

Customers can pick to obtain their money in numerous various ways, including a lump sum, fixed regular monthly settlements, a credit line or a mix of normal settlements and also line of credit. You may be able to obtain even more money with an exclusive reverse mortgage. A HECM therapist or a lending institution can aid you compare these kinds of financings alongside, to see what you'll obtain– and also what it costs. Only the lump sum reverse home mortgage, which offers you all of the proceeds at the same time when your financing closes, has a fixed interest rate. The various other 5 alternatives have flexible rates of interest, which makes feeling because you're obtaining cash over many years, not simultaneously, as well as rate of interest are constantly changing. Variable-rate reverse home mortgages are linked to the London Interbank Offered Rate.

- The price of the upfront MIP is 2% of the appraised value of the home or $726,535 (the FHA's borrowing restriction), whichever is less.

- In some cases, it may also be feasible to expand the timeline for as much as a year.

- HECM loans are often the least costly reverse mortgage you can get from a bank or mortgage company, as well as in most cases are considerably less expensive than other reverse mortgages.

- It has become apparent the real factor for Financial Evaluation is the FHA HECM is an "privilege car loan" similar in extent to Social Safety.

Instead, you can borrow approximately 60%, or even more if you're making use of the cash to settle your forward mortgage. If you select a lump sum, the quantity https://www.einnews.com/pr_news/520298879/wesley-financial-group-announces-new-college-scholarship-program that you get up front is all you will certainly ever get. If you choose the line of credit history, after that your credit line will certainly expand with time, yet just if you have extra funds in your line. The HECM represents almost all of the reverse home loans that loan providers use on home values below $765,600 and is the type that you're probably to get, to make sure that's the kind that this short article will discuss.

You Wont Pay Taxes On The Money You Obtain

Reverse home mortgages can consume the equity in your house, which implies fewer possessions for you and also your successors. A lot of reverse home mortgages have something called a "non-recourse" clause. This implies that you, or your estate, can not owe more than the value of your home when the finance becomes due as well as the house is sold. With a HECM, normally, if you or your beneficiaries intend to settle the lending as well as keep the house as opposed to market it, you would certainly not have to pay greater than the evaluated value of the residence. A reverse mortgage can be a practical economic device for senior home owners who recognize exactly how the car loans work and also what tradeoffs are included.

Versatile Settlement Choices

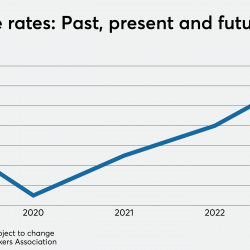

Some banks and also financial institutions offer their very own reverse home loans. These fundings are backed by the exclusive firms that provide them; they are NOT guaranteed by the federal government. It's advised that you proceed exceptionally very carefully if you're thinking of securing a reverse home loan. Single-purpose reverse home loans are the least pricey choice, however they can just be made use of for one purpose. For example, Minnesota uses theSenior People Real estate tax http://www.wesleygroupfinancial.com/when-it-finally-clicks-wesley-financial-group-reviews-strides-against-timeshare-fraud-problems/ Deferral Program, which is a low-interest car loan to help senior citizens pay their property taxes. Interest rates may differ and the stated price might transform or not be offered at the time of car loan dedication.

Note that the adjustable-rate HECM offers all of the above payment choices, yet the fixed-rate HECM only supplies lump sum. In a 2010 study of elderly Americans, 48% of participants mentioned economic problems as the key factor for getting a reverse mortgage and also 81% specified a desire to stay in their current residences till death. Read on to read more regarding how reverse home mortgages function, qualifying for a reverse mortgage, getting the very best deal for you, and just how to report any kind of fraudulence you may see. A home equity lending is a customer lending safeguarded by a bank loan, permitting house owners to borrow against their equity in the home. The average consumer's preliminary principal limit has to do with 58% of the maximum claim amount. The finance earnings are based on the age of the youngest borrower or, if the customer is wed, the younger spouse, also if the more youthful spouse is not a consumer.

They should live and also have actually lived in the home as their primary residence when the reverse mortgage loan came from. You might outlive your funding's advantages if you don't select to get regular monthly settlements throughout the life of the funding. HECM reverse home loan is the most common kind, obtained by means of Federal Housing Administration -approved lenders. Department of Housing and also Urban Development approximately $$ 970800for 2022.

Ingen kommentarer endnu